Advertisement

About 9 million U.S. citizens live overseas, and many don’t know about their tax obligations. For expatriates, understanding taxes is tough but necessary to avoid penalties. It’s key to know your tax duties to keep your legal status while abroad.

We will give important tax tips for expats, including financial advice and how to handle offshore banking. It’s important to know this as you live overseas. Getting to know these tax basics helps protect your interests and avoid future problems. Start by learning about your tax responsibilities and how offshore banks can help manage your money.

Understanding Your Tax Obligations as an Expat

Living abroad as a U.S. citizen means you must understand your tax duties. Every year, the U.S. government expects you to file a tax return, no matter where you live. Knowing your tax responsibilities is key to avoiding fines. Let’s look at the important parts of staying tax-compliant while living overseas.

U.S. Citizens and Tax Responsibilities

Every U.S. citizen, even those living abroad, must file a tax return each year. How much you need to earn before filing depends on your age and whether you’re single or married. Not following these rules can result in big fines. But, there are tax breaks for expats that could lower how much tax you owe.

Dual Taxation Agreements

Many countries have deals with the U.S. to stop expats from paying tax twice on the same money. These deals let you claim tax credits for taxes paid to another country. This can reduce your tax burden and help you follow both local and U.S. tax laws.

Filing Requirements Based on Income

The amount of money you make changes when you need to file a tax return with the IRS. Knowing these rules helps you avoid penalties. It’s also crucial to know which forms you must fill out based on what kind of income you have.

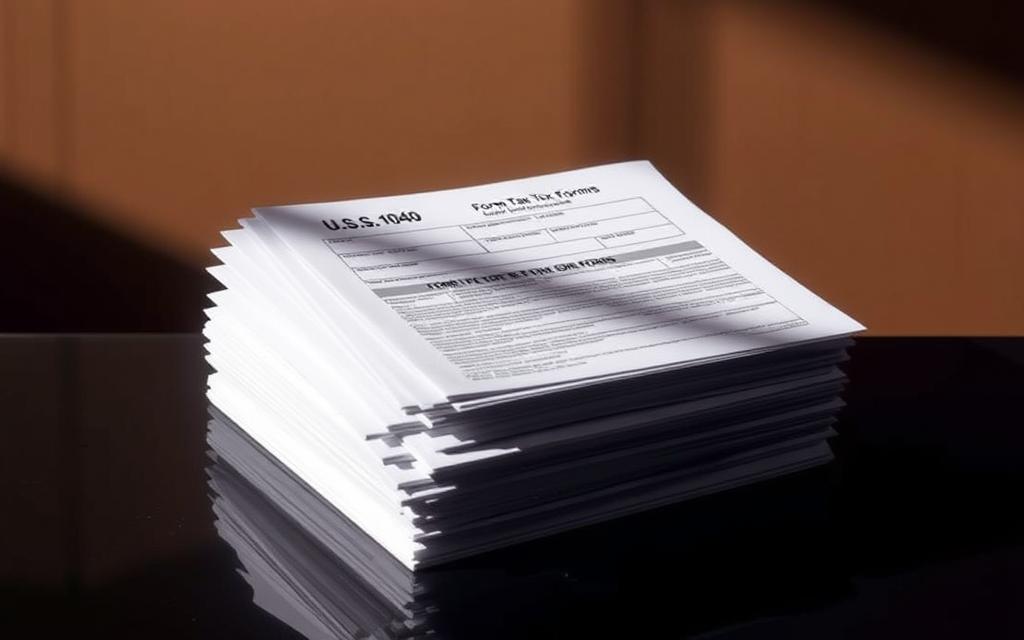

Key Tax Forms for Expats in the U.S.

For U.S. expatriates, understanding key tax forms is crucial. Knowing these forms helps comply with U.S. tax laws and get benefits. The main form is Form 1040, the standard tax return.

Form 1040: The Standard Tax Return

Form 1040 is important for all U.S. citizens, even those abroad. It outlines your income, deductions, and credits. It’s key for showing your worldwide income. Making sure it’s correct keeps you in good standing with the IRS.

Form 2555: Foreign Earned Income Exclusion

U.S. expats can use Form 2555 for a tax break. It lets you not pay U.S. taxes on some foreign income. You must pass certain tests to qualify. Filling this out right helps lower your taxes.

Additional Forms for Foreign Bank Accounts

U.S. expats need to know about forms for foreign bank accounts, too. The FBAR is needed if you have foreign accounts over a certain amount. Not reporting these can mean big fines. Knowing this helps you follow U.S. Treasury rules.

Tax Benefits Available to Expats

U.S. expatriates can enjoy several tax breaks. These can make life overseas less costly. Key benefits include the Foreign Earned Income Exclusion, the Foreign Tax Credit, and deductions for housing expenses.

Foreign Earned Income Exclusion

The Foreign Earned Income Exclusion lets expats not pay U.S. taxes on part of their foreign income. This can lower how much tax they owe. For 2023, they could exclude over $120,000. To use this, expats must meet certain rules.

Foreign Tax Credit

Expats often pay taxes in their new home country. The Foreign Tax Credit helps reduce how much tax they owe in the U.S. It stops them from being taxed twice on the same income. By claiming this credit, expats can save money.

Deductions for Housing Expenses

Expats can also lower their taxable income by deducting housing costs. This includes rent and utilities. These deductions help expats save on taxes while living overseas.

| Tax Benefit | Description | Potential Savings |

|---|---|---|

| Foreign Earned Income Exclusion | Excludes foreign-earned income from U.S. taxes | Up to $120,000 in 2023 |

| Foreign Tax Credit | Reduces U.S. tax liability based on foreign taxes paid | Dollar-for-dollar reduction |

| Deductions for Housing Expenses | Allows deductions for qualifying housing costs | Varies based on actual expenses |

Navigating State Taxes While Abroad

Knowing state taxes is key for expats to keep financial health good while living overseas. Many states have different tax rules for their residents. It’s important for expatriates to understand what they need to do. This way, they can meet their tax duties while living abroad.

Which States Impose Taxes on Expats

Some states still require expats to pay taxes even when they live outside the U.S. California, New York, and Illinois have strict tax rules for expatriates. If you’re from these states, you need to know the rules to avoid fines and unexpected costs.

Maintaining Residency Status

Your residency status affects your tax duties a lot. Many states have actions you must take to show you’re not a resident anymore. This can include proving you live in another country, getting permanent residency there, or filing documents to change your residency status. Not doing this can mean you owe state taxes you didn’t expect.

Filing State Taxes from Overseas

To file state taxes from abroad, you need to know both U.S. and state tax laws. Gather all your income info, from the U.S. and abroad. Most states let you file online or by mail. Make sure you meet deadlines and follow their rules. This helps you stay compliant and avoid fines.

| State | Tax Type | Key Requirements |

|---|---|---|

| California | Income Tax | Non-residents must file if income exceeds certain thresholds |

| New York | Income Tax | All income earned by residents must be reported |

| Illinois | Income Tax | Tax applies to worldwide income for residents |

| Florida | No State Income Tax | No specific filing required for expats |

Common Mistakes Expats Make with Taxes

Taxes can be super tricky for expats. There are a bunch of mistakes they might make, which could end in fines or losing out on money. Knowing what these are and how to dodge them is super important.

Failing to File on Time

Many expats think living outside the U.S. means they don’t have to file taxes. That’s not true, and thinking so can lead to big fines and stress about money. It’s smart to keep an eye on those deadlines and keep proper records.

Ignoring Foreign Bank Account Reporting

Not reporting foreign bank accounts is a huge no-no. If expats skip on the FBAR thing, they could face some serious fines or even legal trouble. Making sure to report when needed can save a lot of headaches.

Misunderstanding Tax Treaties

Lots of expats don’t get the full picture when it comes to tax treaties. This can mess up their tax filings and make them miss out on savings. Figuring out how these treaties work can help save money and avoid problems.

| Mistake | Description | Consequences |

|---|---|---|

| Failing to File on Time | Missing tax return deadlines resulting in penalties | Fines and accrued interest |

| Ignoring Foreign Bank Account Reporting | Failure to report foreign bank accounts as required | Severe fines and legal complications |

| Misunderstanding Tax Treaties | Inaccurate filing due to lack of knowledge about treaties | Missed deductions and potential overpayment |

Resources for Expats Seeking Tax Assistance

Living abroad brings tax challenges for U.S. citizens. Thankfully, many resources exist to make things easier. Experts in expat tax issues offer tailored advice. They help understand tricky tax rules and follow both U.S. and international tax laws.

Professional Tax Services Specializing in Expatriates

Using professional tax services can make tax filing simpler. Firms like H&R Block Expat Tax Services and Greenback Expat Tax Services cater to Americans abroad. They provide advice on deductions and credits for expats.

Online Resources and Tools

Expats can also use online tax tools. Tax calculators and websites provide the latest tax information. These resources help manage finances well while living outside the U.S.

Expat Communities for Shared Insights

Joining expat communities offers valuable tax insights. Online forums and social media groups are places to share experiences and advice. They offer tips and warn of common mistakes, making tax navigation easier.